Selling a home isn’t just about timing the market—it’s about understanding the economic environment and how it shifts directly influences your property’s potential. For homeowners looking to make a move, anticipating how changes like interest rates, inflation, and employment affect the market can help maximize their sale. If you need to act quickly, discovering options like “Sell My Property Fast Salem” may be a smart starting point to ensure a smooth transaction even in uncertain times.

Navigating these economic ups and downs empowers sellers to set the right price, attract serious buyers, and close deals confidently. Below, we break down which economic factors most impact home sales and what you can do to tip the odds in your favor, supported by expert insights and recent data.

Employment Levels and Housing Demand

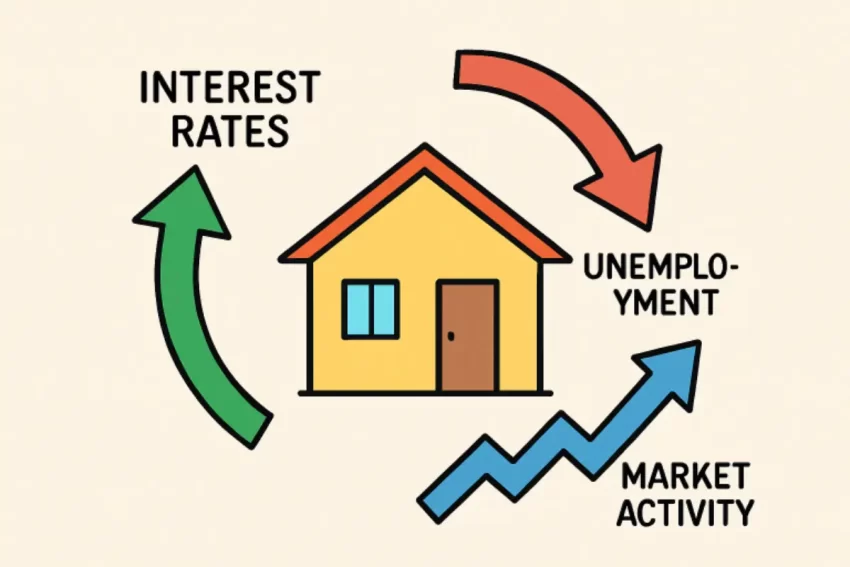

A strong job market is vital in supporting the real estate sector. When employment is high, more individuals feel financially secure and are more likely to purchase homes, driving up demand. Conversely, rising unemployment leads to fewer qualified buyers, longer listing times, and reduced home values. Research indicates that a 1% rise in unemployment can decrease home sales by as much as 4%. Exploring a get cash offer option can provide a faster, more reliable alternative for homeowners looking to sell quickly in uncertain markets.

Interest Rates and Buyer Affordability

Interest rates are among the most influential factors shaping real estate trends. Lower rates directly translate to more affordable mortgages, encouraging more buyers to enter the market and, often, boosting home values. On the other hand, a rate hike—even by 1%—can push monthly mortgage payments higher, reducing buyer eligibility and overall demand. Sellers in high-rate markets may notice longer listing times and greater competition among available homes.

Inflation and Property Values

Inflation affects the costs of building new homes and buyers’ purchasing power. Rising inflation means higher material and labor costs, which put upward pressure on property prices. However, it also eats into family budgets, making it harder for some buyers to save for down payments or qualify for larger mortgages. These twin forces can stall market activity or shift demand toward more affordable homes.

When consumers feel secure about their personal finances and the broader economy, they’re far more likely to pursue big purchases—like homes. High consumer confidence frequently aligns with surging demand, bidding wars, and rising prices. But when confidence dips due to stock market volatility or worries about recession, prospective buyers tend to pause or withdraw, stalling sales.

Government Policies and Incentives

Local and national policies can stimulate real estate market activity or present new seller challenges. Incentives like first-time buyer tax breaks, mortgage interest deductions, or down payment assistance programs can bring more buyers into the market. Conversely, new regulations such as tighter mortgage qualification standards or higher property taxes may reduce demand. In recent years, fluctuating activity has been seen in response to policy shifts.

Supply and Demand Dynamics

The balance between the number of homes for sale and active buyers in the market determines whether conditions favor sellers or buyers. In economic booms, housing demand can outpace new construction and listings, leading to seller’s markets with quick sales and premium pricing. Conversely, slow economic periods usually see homes spend more days on the market and prices see downward pressure as supply exceeds demand.

Navigating the Market During Economic Downturns

Selling a home during a recession or economic downturn presents unique hurdles. With fewer buyers and increased economic anxiety, sellers face more competition and downward price pressure. Home sales may become highly negotiable, with buyers requesting repairs, concessions, or closing cost assistance. Quick, strategic action—such as realistic pricing and strong home presentation—becomes critical to attracting offers and closing deals in uncertain markets.

Strategies for Successful Home Selling

- Price it Right: Analyze comparable sales and market trends in your area to set a price that attracts serious interest and avoids lingering on the market.

- Stage Your Home: Investing in deep cleaning, neutral décor, and minor repairs can make your listing stand out and sell faster.

- Utilize Online Marketing: Professional photos, virtual tours, and compelling online listings can be pivotal, especially when buyer activity is lower.

- Offer Incentives: Consider offering closing cost assistance, flexible move-in dates, or warranties to overcome buyer hesitancy and facilitate faster sales.

- Stay Positive and Realistic: Recognize that in slower markets, homes may take longer to sell, but proactive and flexible approaches often pay off.

By considering economic trends and actively preparing for changing market conditions, sellers can increase their chances of a quick and profitable home sale regardless of market cycles.